Any time a company exceeds or lags quarterly profit forecasts by a big margin, the resulting share price action is quite predictable. Indeed, the list of stocks making recent 52-week highs are dominated by companies that posted stellar third-quarter results.

But the market action doesn't always play out that way. On occasion, a company will handily surpass consensus profit forecasts, analysts will boost their outlook for the next year, and yet the stock price falls in value.

How do you explain such a disconnect?

Perhaps some investors were looking for even greater upside than the company delivered. Or perhaps investors have begun rotating out of the company's industry, selling off all stocks in the group on an indiscriminate basis. Whatever the reason, a combination of surging profits and falling share prices is a nearly perfect setup.

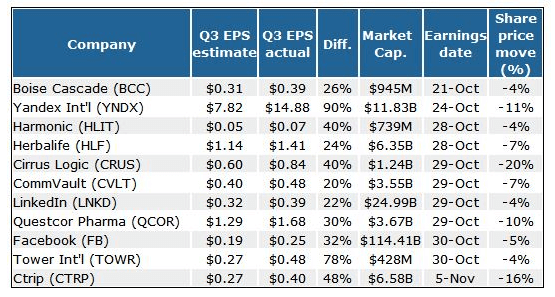

I reviewed several hundred stocks that topped third-quarter profit estimates by at least 20%. Predictably, the vast majority surged higher in response. But I was able to come across three dozen companies that fit the backdrop of 'good earnings/bad share response.' From there, I tossed out any stocks in which analysts lowered their 2014 profit forecasts after the quarterly conference call. If a company blew past third-quarter estimates but expressed caution about the year ahead, then the earnings surprise isn't really notable.

We're left with 11 stocks, all of which exceeded third-quarter EPS (earnings per share) forecasts by at least 20%, all of which now have 2014 consensus profit forecasts that are higher than when earnings season began, and all of which have actually fallen in value since earnings were released.

The biggest name here, of course, is Facebook (Nasdaq: FB), which delivered a classic 'beat & raise' quarter. So why did shares fall? Because as I noted in a column discussing this stock's great upward move over the summer: 'Wall Street's positive perception of Facebook is what has really changed, and now there is a real risk that analysts (and investors) are loving this stock too much.' In effect, Facebook is now held to a much higher standard than it was before, and the company would have needed a truly mind-blowing quarter to give the shares a fresh boost.

It will be interesting to see how Facebook trades over the next few months, this stock is either loved or hated, and if investors decide to start booking profits on the summer's gains, and shares move below $40 on concerns about a fairly rich near-term earnings multiple, then a fresh buying opportunity will be in place -- especially as Facebook's long-term outlook gets ever brighter.

I've got not such interest in the outlook for LinkedIn (Nasdaq: LNKD), which still looks remarkably overvalued by a range of measures, even after a recent pullback. The social networking site has always blown past estimates, but by ever-smaller amounts. The 21.9% upside, relative to the consensus, was LinkedIn's worst showing in a number of quarters.

But there are some clear openings in this group. My favorites for further research include:

Boise Cascade (NYSE: BCC)

This company is a direct play on the housing market, as it has strong market share in the various woods used in new home construction. The housing market plunge in recent years is quite evident in BCC's results. Sales exceeded $5 billion every year from 2004 through 2007, but plunged below $2 billion by 2009. Yet sales rebounded 24% in 2012 (to $2.8 billion), and appear likely to approach $4 billion next year.

This company was brought public earlier this year when enthusiasm over the housing market was building. Yet as you can see from the stock chart, that enthusiasm has waned.

Even analysts have taken a more cautious tone to housing stocks. 'While we like BCC's leverage to recovering U.S. housing, we remain ('neutral') on BCC given the recent moderation in U.S. housing momentum,' note analysts at Goldman Sachs (NYSE: GS), even as the firm used solid third-quarter results as a chance to raise 2013, 2014 and 2015 EPS forecasts by around 10%.

And here's the rub: Goldman reiterated its neutral stance and $30 price target when shares traded at $26.85. Shares have since slipped below $24, or less than eight times Goldman's 2015 profit forecast. If you take a longer view of the housing market recovery, then the recent pullback should be seen as an opening. D.A. Davidson has a similar $31 price target, which is based on a target of seven times projected 2014 earnings before interest, taxes, depreciation, and amortization (EBITDA).

Herbalife (NYSE: HLF)

It's hard to make heads or tails of this controversial stock. My colleague Marshall Hargrave took an in-depth look at the competing viewpoints around this nutritional supplement seller back in September.

I only note the company now because it has both blown past third-quarter profit estimates (by 24%, its largest margin in many quarters), analysts have raised their forecasts, and shares have slumped since earnings came out. Trading at 11 times projected 2014 profits, Herbalife would seem to be a bargain, but it's not a stock I'd go out on an limb and recommend.

Ctrip.com (Nasdaq: CTRP)

China has more than its share of fraudulent companies, but you can't totally ignore Chinese stocks -- some very high-quality business models have emerged as well. And Ctrip, which is China's largest online travel agency, is a name you should know.

The company has grown at a strong pace over the past five years, and in light of still-low penetration rates for online travel bookings in China, it still has ample growth ahead.

Nevertheless, some investors recently chose to take profits in this stock in tandem with the third-quarter earnings release, after shares had posted solid gains over the prior few months.

In the third quarter, Ctrip saw strong growth in hotel bookings (up 34% from a year ago), airline tickets (26%), leisure package tours (43%), and corporate travel (33%). That helped Ctrip to surpass quarterly profits estimates by more than 40%, which was also the case in the previous two quarters.

This isn't an inexpensive stock, but it probably never will be in light of the robust growth prospects. Yet the recent pullback provides an opening for those that had been awaiting an entry point.

Risks to Consider: The pullback in these stocks, even as they delivered solid third-quarter results, implies that momentum investors are being shaken out. So these stocks could fall a bit further until the fast-money crowd has left the room.

Action to Take --> Earnings season provides a great chance to find new values that the market discards. In these cases, solid third-quarter results are likely a harbinger of more good quarters to come, and share prices are now incrementally more attractive.