If you're wondering whether your local bank is on sound financial footing or whether it could be headed for trouble, then the first thing you should do is examine its Texas ratio.

Financially strong banks typically have low Texas ratios, while highly leveraged or struggling banks tend to have high Texas ratios.

Over the years, we've received an unprecedented amount of feedback from readers asking how they can get the data to calculate Texas Ratios on their own.

The beauty of the Texas ratio is that it's comprised of seven data points from financial info banks provide to the FDIC and the FDIC provides to the public. So unless the banks are lying to the FDIC, the data is accurate. After that, it's just a matter of 'plugging and chugging,' as my old finance professor used to say.

What Is the Texas Ratio Formula?

The formula for the Texas ratio, as defined by its inventor, Gerard Cassidy, is:

The formula is defined and explained in the InvestingAnswers Financial Dictionary.

Here is the formula for tangible common equity (TCE):

TCE = Common Equity - Preferred Stock - Intangible Assets

TCE is defined and explained in the InvestingAnswers Financial Dictionary.

With just a little bit of 8th-grade algebra, we can expand the Texas ratio formula to its full expression:

And finally, we make just one more modification. Some banks have loans that are backed by the U.S. government. These loans are made under special programs for veterans, first-time homebuyers, etc. The banks won't lose money if people default on these loans (the federal government 'guarantees' them and will reimburse the bank for any losses).

So to get a more accurate picture of the 'bad' loans on a bank's books, we need to take out the loans that will never go bad. Andy made this modification in the original articles, so we will, too. That gives us our final formula:

.gif)

I know it looks complicated, but it's only seven pieces of data. Now I'll show you how to track down the numbers we'll plug into the formula.

How to Calculate the Texas Ratio for Any Bank in the U.S.

1) Follow this link to the FDIC website.

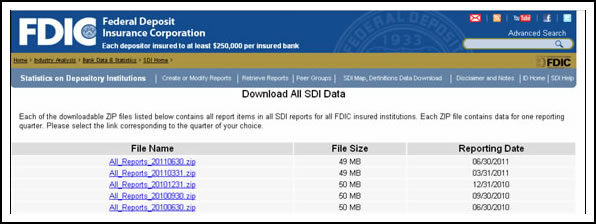

2) Click the link marked 'Download All.' You'll come to a page that looks like this:

3) Click on the zip file you want to download. I'm assuming you'll want the most recent file, but you can go back and look at as many years as your heart desires.

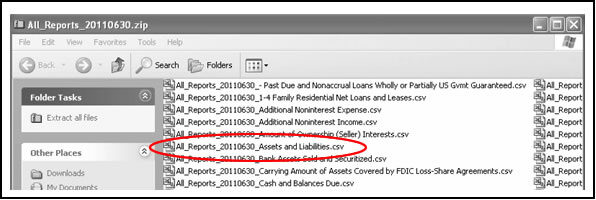

4) Once the files have downloaded onto your computer, double-click the file to open a window that looks something like this:

Look for the file labeled 'All_Reports_Assets and Liabilities.'

5) Double-click on the file labeled 'All_Reports_xxxxxx_Assets and Liabilities.csv.' When you open the file, you'll see a very, very large collection of data in an Excel spreadsheet. It will look something like this:

.jpg)

Don't get overwhelmed. Here's exactly where to find the seven pieces of data you need:

6) If you want to calculate the Texas ratio of a specific bank, the easiest way to find it is by using Excel's 'Find' feature, which is found in the 'Edit' menu. Enter the term you'd like to search for, then keep clicking 'Find Next' until you reach the row with the bank you're looking for.

Now it's just a matter of using this formula to calculate the Texas ratio for any and all banks that interest you:

7) Now we just need to interpret the results. As a general rule of thumb, as the ratio approaches or exceeds 1.0, the risk of failure rises.

The Texas ratio takes into account two important factors in a bank's health: the number of bad loans it's made and the cushion the bank's owners have provided to cover those bad loans (i.e. common equity).

If too many of the bank's loans are nonperforming (as described by the Texas ratio's numerator), the bad loans will erode the bank's equity cushion, which could cause the bank to fail.

Likewise, if there is not enough equity in a bank (as described by the Texas ratio's denominator), the bank will not be able to absorb very many bad loans and the bank may fail.

The Investing Answer: While the Texas ratio is good, it isn't perfect. Please bear in mind that the Texas ratio is a simply one predictive indicator. And just as no one metric can tell you whether a stock is a good buy, the Texas ratio alone cannot tell you whether a bank is sound. Basically, it's important to realize that the ratio only points to increased risk of failure, and does not imply that failure is imminent or inevitable.