It's the best electrical conductor of any metal, and may soon replace the lithium-ion in batteries used in future Apple (NYSE: AAPL) iPhones and laptops.

It's highly reflective, making it a perfect choice for the increasingly popular photovoltaic solar panels.

It's strong enough to withstand thousands of pounds of pressure and continuous abuse, making it the metal of choice for ball bearings on jet engines.

Its antibacterial properties prevent infection and speed healing. It's even used to purify one of the few limited resources that we would literally die without -- water.

This metal is already a strong investment.

Oh yeah -- and it's one of only two metals the U.S. considers legal tender.

As you've probably realized by now, the super metal we've been talking about is actually silver, and there's no reason it shouldn't be part of your investment portfolio.

The Case for Silver-Lining Your Portfolio

1. Because silver is used in more products and services around the world than gold, its value will be prolonged and preserved for decades -- even during crises or financial collapse.

2. Silver is a great complementary asset to gold. For example, if gold prices rise to new record highs (as it has been), the expensive yellow metal will become less attractive to industrial users, jewelry buyers and central banks. In this event, many suppliers of these products will substitute gold with the much less expensive but still shiny and durable metal, silver.

This 'substitution effect' would cause prices of gold to fall. In this instance, your total returns would suffer if your portfolio happened to be only invested in gold. However, if your portfolio happened to also be invested in silver (which would rise in price due to the substitution effect), the negative returns of the gold could be offset.

3. Affordability. The metal is much less expensive per ounce than gold, so an investor can purchase more 'units' to increase their exposure to precious metals without breaking the bank.

4. There are lots of different ways to invest in this metal, making it super convenient.

Investing in Silver ETFs and Mutual Funds

Want to invest in silver, but don't want to hassle of actually storing it? Exchange-traded funds (ETFs) and mutual funds make owning silver as easy as buying shares of Microsoft (Nasdaq: MSFT).

The iShares Silver Trust Fund (NYSE: SLV) and the ETFS Physical Silver Shares (NYSE: SIVR) both track and reflect the price of actual silver (minus management fees).

If you want to further diversify your silver strategy, you can even invest in the silver mining companies themselves through the GlobalX Silver Miners ETF (NYSE: SIL).

Advantages: Lower premium (fund expenses only) on your investment and easy to add to an IRA or other brokered investment account. You don't have to store physical silver bricks or coins.

Disadvantages: ETFs and funds cannot be redeemed for actual silver, only cash, which generally holds little value in a market collapse or hyperinflationary environment.

Investing in Silver Bars, Rounds and Coins

Though ETFs and funds are easy to add to a portfolio, they are not the best option if you're looking to protect your wealth from the possible threats of a falling dollar, hyperinflation, failing government, or a market collapse.

When you purchase physical forms of silver bullion (in the form of bars, rounds and coins), you not only profit from silver's rising prices, but protect yourself from these threats.

The majority of .999 fine silver bars come in 100-oz size, with the most popular brand names being Engelhard and Johnson Matthey. Other fine silver bars that come in a heavy, 68 pound, 1,000-oz size are usually delivered commercially and are labeled by COMEX or LBMA (entities that hold large amounts of gold and silver). Their cost to produce is lower than most coins and rounds but they can be difficult to store.

Silver rounds look like coins at first glance, but they are produced by non-federal mints and can be customized with various designs or faces. Silver rounds carry a lower premium price for production than silver coins for the amount of silver content they possess, but they are not considered legal tender as most silver coins are.

Silver coins have been federally minted by many countries, but the American Silver Eagle is the only official silver coin minted in the United States. Other forms of silver coin are the 99.99% pure Canadian Silver Maple Leaf and 'junk-silver' coins. 'Junk-silver' coins are those widely-collected U.S. coins minted before 1964 that contain 90% silver content.

Official silver coins (especially collectable editions) generally charge a slightly higher premium than other physical forms of silver. However, American Silver Eagles and Silver Maple Leafs are the only silver coins with legal tender status, and carry an official guarantee of weight and purity by their federal mints (You can verify a dealer's ASE coins here for authenticity). An investor looking to buy one ounce of silver at a time may also find coins easier on the monthly budget than buying a single silver bar that may cost several hundred dollars.

Buying physical silver is just as easy as shopping online. Kitco and the First Federal Coin Corp. are two great places to start.

Advantages: Physical silver may be put in a tax-deferred 'Precious Metals IRA' or Self-Directed IRA so long as it's at least .999 fine silver (like the official American Silver Eagle coin). Physical silver will also become more valuable as a potential medium of exchange as governments print more paper money and devalue their currencies.

Disadvantages: Physical silver in bar form can be difficult to store due to its heavy weight and volume. Silver rounds may not be used as legal tender and it can be difficult to verify their purity. If you're looking to invest in physical silver, your best bet are federally minted silver coins.

[Want to invest in gold too? See Is One Ounce of Gold Actually Worth $5,500?]

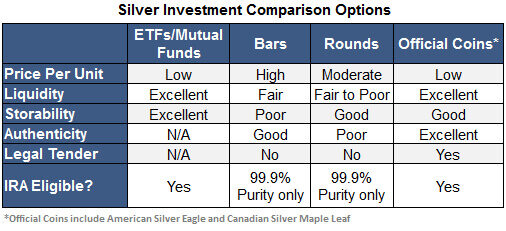

The Investing Answer: Choose silver tracking ETFs and mutual funds with low expense ratios to easily add diversification to your investment portfolio. But if you're an investor looking to preserve wealth and gain from silver's future growth, choose bars, rounds or official coins.

There are pros and cons to each type of silver investment, so choose what's best for you:

Adding silver to your investment mix of gold, stocks and bonds could be the best combo for a well-diversified, inflation-defiant, gold-and-silver-clad portfolio.